In today's dynamic business environment, credit repair companies need every benefit they can get. Cloud-based software offers a powerful resource to streamline your operations, convert more clients, and ultimately maximize your bottom line.

Employing the flexibility of the cloud allows you to utilize client data from anywhere with an internet connection. This facilitates your team to work more productively, lowering administrative burdens and freeing up time to focus on what matters most: helping clients rebuild their credit.

- Efficient reporting and client updates save you valuable time and resources.

- Comprehensive data protection ensures your clients' information is always safeguarded.

- Instantaneous insights into client progress allow for personalized support and approaches.

By embracing cloud-based software, your credit repair business can prosper in today's market. Don't to research the many benefits this technology has to offer and establish yourself for long-term growth.

Credit Repair Cloud The Ultimate Solution for Building a Thriving Business

Are you searching for a way to expand your business and attain financial success? Credit Repair Cloud is the ultimate solution for entrepreneurs who want to generate a lucrative venture. With its robust suite of tools, Credit Repair Cloud empowers you to control your client's credit reports, challenge negative items, and strengthen their credit profiles.

Utilizing the power of Credit Repair Cloud, you can offer a more info valuable service to clients who are facing credit challenges. Additionally, our intuitive platform makes it simple to manage client accounts and observe their progress.

- Enhance your business revenue by assisting clients improve their credit scores.

- Build a loyal client base by delivering exceptional service and results.

- Earn a competitive edge in the financial services industry.

Dominate the Credit Repair Industry with Our Innovative Software Suite

Are you seeking to build a successful credit repair business? Look no further! Our groundbreaking software suite is designed to help you excel in this competitive industry. With its cutting-edge features, our software will empower you to streamline your workflow, enhance client satisfaction, and ultimately dominate the market.

- Optimize credit report analysis with ease.

- Create professional dispute letters in seconds.

- Track client progress seamlessly.

Empower yourself with the tools you need to thrive in the credit repair industry. Contact us today for a free demo and discover how our innovative software suite can transform your business.

Seamless Credit Repair Management: Streamline Your Workflow in the Cloud

In today's fast-paced environment, managing credit repair can quickly become overwhelming. Juggling multiple accounts and tasks manually is time-consuming. That's where cloud-based credit repair management systems stand out. These solutions provide a centralized platform to track all your client information, reports, and progress. With an intuitive interface and automated workflows, you can efficiently manage your workload and provide exceptional service to your clients.

A cloud-based system empowers you to access client data from anywhere with an internet connection. Work together seamlessly with colleagues and share information in real-time. Simplify repetitive tasks such as sending reminders, generating reports, and monitoring on credit bureau updates.

- Enhance your productivity by minimizing manual data entry and administrative overhead.

- Achieve valuable insights into client progress with comprehensive reporting and analytics.

- Optimize client satisfaction by providing prompt and accurate updates on their credit journey.

By embracing a cloud-based approach to credit repair management, you can transform your workflow, save valuable time, and ultimately, secure better outcomes for your clients.

Clients First: The Future of Credit Repair

The credit repair landscape is constantly transforming. Consumers are expecting more than just a quick fix; they want partnerships that empower them to strengthen their financial well-being. Visionary credit repair companies are implementing this shift by putting clients at the core of their strategies. This client-centric approach not only cultivates trust and loyalty but also amplifies a brand's reputation in the market.

By delivering transparent, personalized guidance, credit repair companies can redefine the client experience. This means going beyond simple credit score improvement to provide holistic financial empowerment.

- Client empowerment signifies

- increased client satisfaction and loyalty

- A reputable brand reputation built on transparency

The future of credit repair is here, and it's all about partnership. By prioritizing client needs, credit repair companies can not only thrive but also make a positive impact for their clients and the industry as a whole.

Credit Repair Made Simple: Powerful Tools at Your Fingertips

Taking control of your credit score doesn't have to be overwhelming. With the proper tools and resources at your disposal, you can efficiently navigate the process of credit repair and pave the way for a brighter financial future. Unlock the power of these innovative solutions to enhance your creditworthiness and unlock new opportunities.

- Monitoring your credit reports regularly is the first step towards understanding your current credit standing.

- Dispute any errors or inaccuracies you find on your reports to ensure accuracy and fairness.

- Employ credit-building strategies, such as making timely payments and keeping your credit utilization low.

By embracing these powerful tools, you can improve your credit profile and achieve your financial goals.

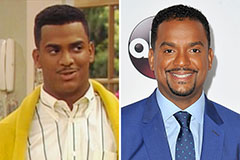

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!